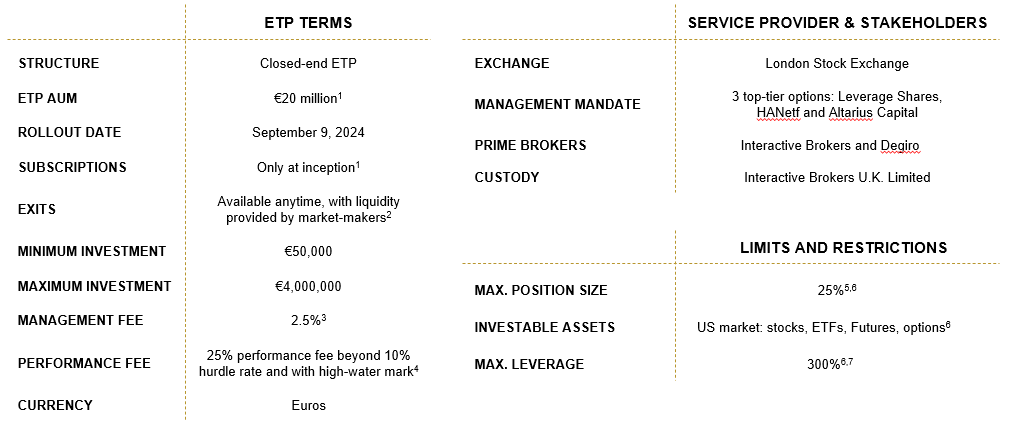

ETP TERMS, PROVIDERS & LIMITS

Minimum investment of €50,000.

Annual management fee of 2.5%. Performance fee of 25% beyond 10% hurdle rate and with high-water mark.

- Relay Race Investments, a closed-end ETP, will have a €20 million hard cap. Future subscriptions are not anticipated; thus, investing post-inception will rely on other investors selling shares. This approach prioritizes returns over Assets Under Management (AUM);

- Liquidity is provided by a market-maker with a spread between bid and ask of 32 basis points (0.32%);

- Management fee of 2.5% per year pro-rated daily; it is calculated over assets under management;

- Performance fee accrued only when the return in the last year (or since inception in the first year) exceeds 10% and, simultaneously, a new high-water mark is reached. Provided that, the performance fee is calculated as 25% of the excess return beyond the 10% threshold;

- This limit refers to maximum position at cost ant it applies solely to specific assets (e.g., stocks). Indices ETFs, already diversified investments, may exceed this limit;

- In RRI’s Manager track record, certain limits may have varied slightly, particularly before 2023;

- Leverage is maintained between 80%-120%, and, occasionally up to 300% for about 20 days/year, with stop-loss protection.

Note: The information provided is purely illustrative. All criteria mentioned are conceptual and for illustrative purposes only. Some information is still preliminary and subject to change, especially until the management mandate is established. This communication should not, under any circumstances, be seen as an invitation to invest in RRI ETP, nor does it constitute a public offering to sell any products described herein. The information herein is solely for informational purposes regarding RRI ETP and should not be seen as a comprehensive description of either the securities or the issuer mentioned. Subscriptions for RRI ETP will be assessed solely based on the terms outlined in the base prospectus.